waterbury ct tax assessor

Live GIS Mapping Sites. Lower Level of Town Hall.

Office Of The Tax Collector City Of Hartford

We always provide a reply email for acceptance of time sensitive submissions.

. Please contact provider for fee information. The Grand List is generated each year in January or February and is a record of all taxable and tax-exempt property as of Oct 1st. This GIS property based map depicts all.

The City of Danbury last completed a revaluation for the Grand List of October 1 2017 and is currently conducting a real property revaluation for the Grand List of October 1 2022. Income and Expense Report 2021 Due June 1 2022. City of Waterbury Assessor.

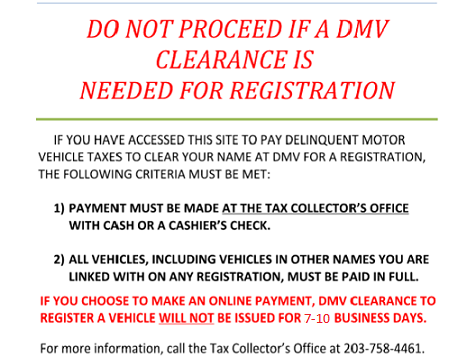

The Tax Collectors Office is a division within the Citys Department of Finance and its primary responsibilities are governed by the State of Connecticut General Statutes and the City of Danbury Ordinances. There are three primary phases in taxing real estate ie formulating tax rates assigning property market worth and taking in receipts. The City of Waterburys Street Index Map.

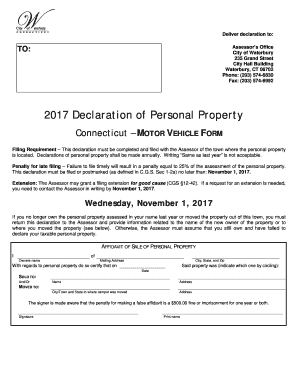

12-130 and 12- 146. Tax Assessors Office provides information on the assessment and value of real estate motor vehicles business property and personal property. View Full Size Map.

The responsibilities of the Assessors office are to discover list and value all real estate motor vehicles and personal property located within the Town of Woodbury and to administer Public Act 490 tax relief programs and exemptions. Watertown Mapping M-3 Quadrennial Application. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Failure to receive a tax bill does not invalidate the tax or interest due. Change of Address Form. City of Waterbury GIS.

Waterbury Connecticut 06702. 235 Grand Street Courtyard Level. Accorded by Connecticut law the government of Waterbury public colleges and thousands of other special districts are given authority to evaluate housing market value set tax rates and assess the tax.

Failure to have received a bill does not exempt the taxpayer from payment of all taxes and all interest charges and collection cost per Conn. Several government offices in Waterbury and Connecticut state maintain Property Records which are a valuable tool for understanding the history of. These responsibilities are done in accordance with Connecticut State Statutes Rules and.

Included in the Grand List are real estate business personal property and registered motor vehicles. PLEASE SEND ALL REQUESTSCORRESPONDENCE TO. EQuality software provides the ability to tailor the valuation model for the specific needs of the Municipality.

The office performs Real Estate Inspections pursuant of open closed permits as well as observing the properties overall condition. The office is also responsible for. Assessors Real Estate Info.

Information on the Property Records for the Municipality of Waterbury was last updated on 07262022. Please call the assessors office in Waterbury before you send documents or if you need to schedule a meeting. Board of Assessment Appeals Information Sheet.

Our Property Record Cards are now being hosted by Equality. Under these statutes and ordinances the Tax Collector mails approximately 200000 tax and utility bills and notices annually. 787 KB Assessor Residential Neighborhoods.

Elderly Homeowners Tax Relief Program Information. GIS based Assessors Tax Map overlaying the 2016 CT ECO Aerial Photograph. CT - New Haven County - Waterbury.

Overlayed by the Assessors Map Index. This revaluation will correspond to the tax bills that will be due beginning in July 2023. All Tax Maps have ROWs and Easements View Full Size Map 1-5 MB.

203 574 6821 Phone The City of Waterbury Tax Assessors Office is located in Waterbury Connecticut. Assessments are computed at 70 of the estimated market value of real property at the time of the last revaluation which was 2017. The Grand List Year is October 1- September 30.

The Assessors Office has the responsibility of assessing every taxable and exempt property located in the City of Danbury and compiling these assessments into the Citys Grand List. Taxable property includes real estate and personal property including motor vehicles. The City of Danbury asks for patience during this process.

Working with the Valuation supervisor the Assessor can customize the data to be gathered and the cost tables to meet their specific needs. The Assessors office is primarily responsible for preparing the Towns Grand List. Please contact provider for fee information.

In doing this we ensure that every property owner is. The main objective of the Assessors Office is to Discover List and Value Real Estate Personal Property and Motor Vehicles for the Towns Grand List. Max Camfield Assistant Assessor.

Public Property Records provide information on land homes and commercial properties in Waterbury including titles property deeds mortgages property tax assessment records and other documents. Equality - Town of Watertown. As owners of property taxpayers are responsible to know when their taxes are due.

Parameter must be an array or an. CT - New Haven County - Waterbury Fees. Get driving directions to this office.

Apply through city tax assessors officeApplication periodsProperty Tax Relief Program 21-515Rent Rebate 41-101Veterans Property Tax Exemption. Nicole Lintereur Assessor. The Assessor does not provide property tax information.

Please be sure to bookmark this link for the most current assessment and ownership information. You can call the City of Waterbury Tax Assessors Office for assistance at 203-574-6821.

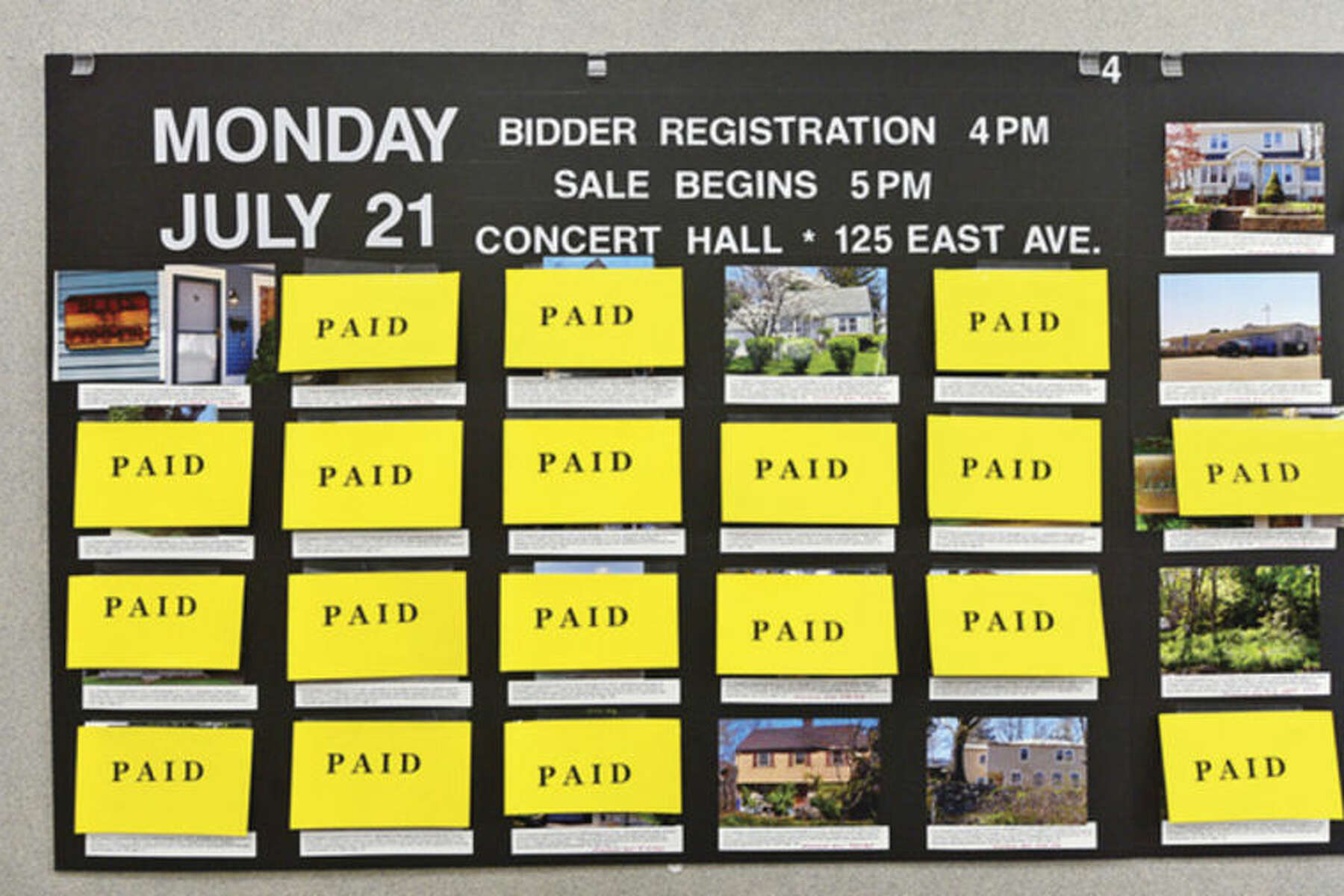

Delinquent Tax Collector State Marshals Work Together To Collect Back Taxes

Horry County Property Tax Bills Mailed

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Horry County Property Tax Bills Mailed

Nonprofit Wins Property Tax Appeal Ct News Junkie

/cloudfront-us-east-1.images.arcpublishing.com/gray/3F3MUZPVTNCVJKKPKRYNDLYFYI.jpg)

Ct Residents Seeing Higher Tax Bill After State Tax Cuts

Governor Lamont Proposes 336 Million In Tax Cuts For Connecticut Residents

Town Of Prospect Tax Bills Search Pay

Real Property Tax Appeals In Connecticut 2012 Update Cohen And Wolf P C

Waterbury Ct Tax Assessor Fill Online Printable Fillable Blank Pdffiller

Innovative Land And Property Taxation By Un Habitat Issuu

How To Win A Ct Property Tax Assessment Appeal Idoni

110 S State Road 19 Palatka Fl 32177 Palatka Palatka Florida Florida